所屬分類:新聞動態發佈時間:2025-04-07

Hong Kong China ESG trends

The 2025 Hong Kong Climate Forum was Successfully Held: Charting New Paths for Green Development and Climate Action.

From March 24 to 25, 2025, the second “Hong Kong Climate Forum,” co-hosted by the Environment and Ecology Bureau of the Hong Kong Special Administrative Region Government, the Hong Kong University Institute of Climate and Carbon Neutrality (ICCN), and the Asian Data Group, among other organizations, was grandly held in Hong Kong. This forum brought together experts and scholars from national ministries, the regional government, domestic and foreign universities, and research institutions, as well as industry elites, to jointly explore the challenges posed by climate change and corresponding measures, contributing wisdom to the green transition and sustainable development of Hong Kong, the Guangdong-Hong Kong-Macao Greater Bay Area, and even the globe.

Mr. Xie Zhanhuan, the Secretary for Environment and Ecology of the Hong Kong Special Administrative Region, shared several government policies and support measures for environmental protection and climate change response at the forum. He also emphasized the use of artificial intelligence and big data in combination with green technology and finance to enhance efficiency. He said, “Industrialization has changed the world. It has improved human life in many ways, while also disrupting the delicate balance of the natural ecosystem that sustains our planet. Carbon neutrality is a formidable challenge, yet it is the only option. For the sake of our children and future generations, let us embrace the green transition and work together to build a new ecological civilization.”

Source: https://www.hku.hk/press/press-releases/detail/c_28200.html

Lianhe Green Insights

Hong Kong, as a bridge connecting the Chinese mainland with the rest of the world, has a highly developed and internationalized financial system, which endows it with great potential in the field of green finance. The successful hosting of the 2025 Hong Kong Climate Forum has demonstrated Hong Kong's unique strengths and proactive role in green development and climate change response. As one of the global hubs for finance, technology, and innovation, Hong Kong has contributed "Hong Kong wisdom" and "Hong Kong solutions" to global climate governance and the green transition by leveraging its role as a bridge, its technological prowess, regional collaborative capabilities, and strengths in talent cultivation. In the future, Hong Kong is expected to play a more significant role in global green development and lead the world towards a more sustainable future.

International ESG trends

The Ministry of Finance Successfully Issues First RMB Green Sovereign Bond in London

On April 2, London time, the Ministry of Finance of the People’s Republic of China, on behalf of the central government, successfully issued 6 billion yuan of RMB green sovereign bonds in London, UK. The issuance included 3 billion yuan of 3-year bonds with an interest rate of 1.88%, and 3 billion yuan of 5-year bonds with an interest rate of 1.93%, both of which were lower than the interest rates of the same-term government bonds in the secondary market in Hong Kong. International investors showed strong interest, with a diverse range of investor types and wide geographic distribution. The total subscription amount reached 41.58 billion yuan, which was 6.9 times the issuance amount.

EU Commission Asks EFRAG to Fast-track Development of Simplified CSRD Sustainability Reporting Standards

The European Commission has tasked the European Financial Reporting Advisory Group (EFRAG) with supporting its plan to significantly simplify the reporting requirements under the Corporate Sustainability Reporting Directive (CSRD), with a request to develop technical advice underlying the CSRD’s European Sustainability Reporting Standards (ESRS), and setting a timeline of only seven months, with a deadline for the new advice of October 31, 2025.

The request comes in the wake of the release in late February of the Commission’s Omnibus I package, aimed at significantly reducing the sustainability reporting and regulatory burden on companies, with proposals for major changes to a series of regulations including the CSRD, the Corporate Sustainability Due Diligence Directive (CSDDD), the Taxonomy Regulation, and the Carbon Border Adjustment Mechanism (CBAM).

Mainland China ESG trends

Notice on Soliciting Opinions on the “Interim Detailed Rules for the Issuance of Renewable Energy Green Power Certificates (Draft for Comments)” by the Integrated Department of the National Energy Administration

In order to regulate the issuance and management of green certificates, based on the “Rules for the Issuance and Transaction of Renewable Energy Green Power Certificates”, the National Energy Administration has drafted the “Interim Detailed Rules for the Issuance of Renewable Energy Green Power Certificates” (Draft for Comments). The National Energy Administration now solicits public opinions on this draft.

Source: https://www.nea.gov.cn/20250331/6868b1af236947929f6d0276a7e2605a/c.html

The Research Report on the Development Roadmap of China’s Hydrogen Energy Technology is Officially Released

On March 26, the Research Report on the Development Roadmap of China’s Hydrogen Energy Technology was officially released at the 2025 International Hydrogen Energy Conference and International Hydrogen Energy and Fuel Cell Industry Exhibition.

The report indicates that in 2023, China’s total hydrogen production was approximately 35 million tons per year, of which coal-based hydrogen accounted for about 60%, while natural gas-based hydrogen and hydrogen from industrial by-products each accounted for about 20%. It is necessary for China’s hydrogen production to gradually transition from being primarily based on fossil energy to being mainly based on low-carbon/clean hydrogen production from renewable energy.

Source: https://h5.h2cn.org.cn/3vdja5/202503/9a69004d03dc7e7e9e0e568ad3eae726.html

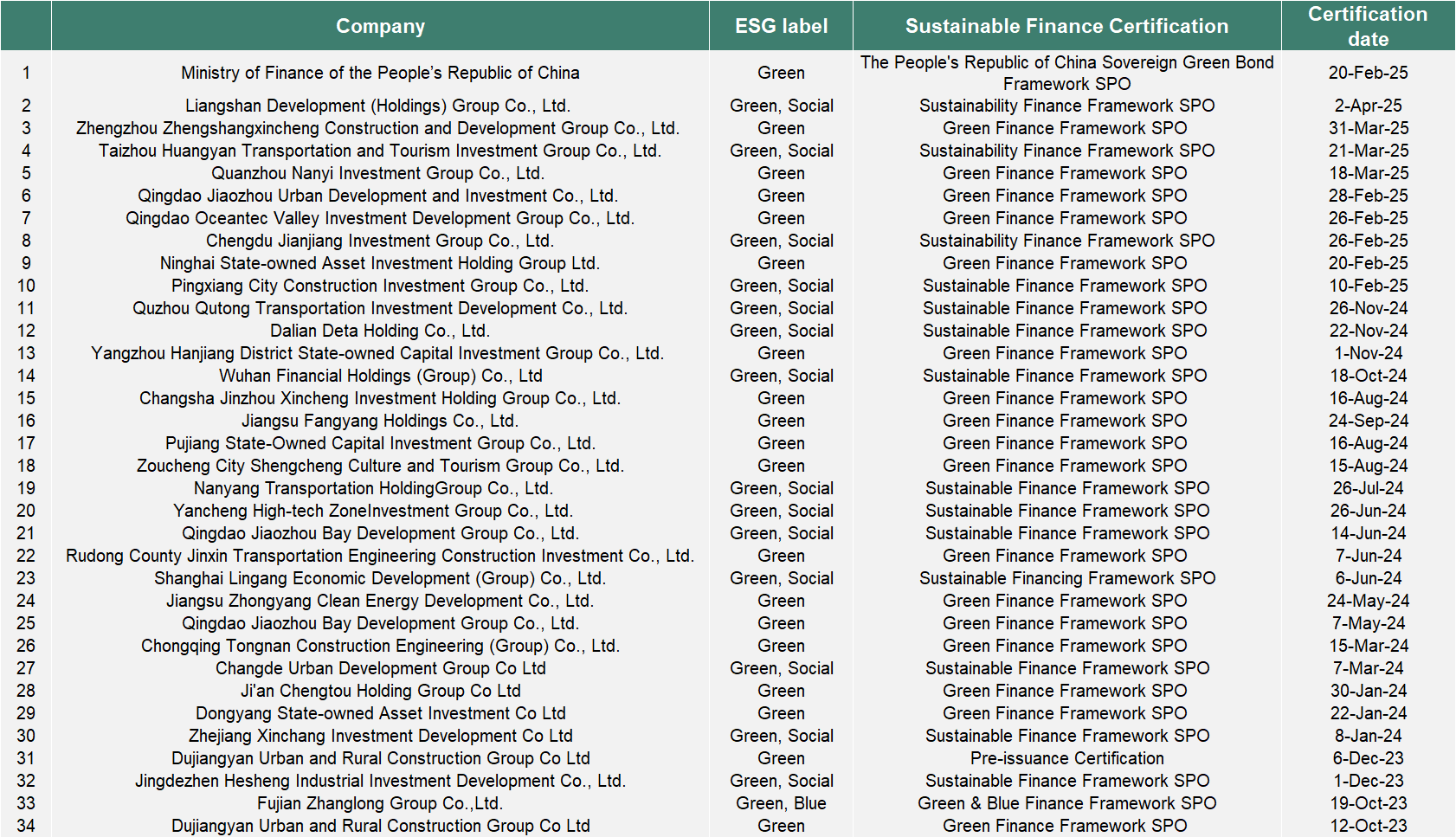

Sustainable Finance Certification Public and Completed by Lianhe Green