所屬分類:新聞動態發佈時間:2024-10-21

Hong Kong China ESG trends

Hong Kong firms to face warnings, fines for flouting plastics ban after grace period

Businesses violating Hong Kong’s single-use plastics ban after the end of a grace period will be warned and fined if they do not make the necessary changes in 10 working days, the environment minister has said.

Hong Kong introduced the first stage of the ban on April 22 and prohibited venues from offering disposable plastic items, such as straws, cutlery and tableware for dine-in or takeaway meals. Other disposable products such as plastic stemmed cotton buds and umbrella bags are also banned for sale and free distribution.

The ban’s six-month grace period ends on October 21, while a second phase could start as early as 2025.

Source: myNEWS (Hong Kong firms to face warnings, fines for flouting plastics ban after grace period | South China Morning Post)

International ESG trends

EU deforestation law: Council agrees to extend application timeline

On October 16, the Council of the EU agreed on its position on the targeted amendment of the EU deforestation regulation, postponing its date of application by 12 months.

This postponement will allow third countries, member states, operators and traders to be fully prepared in their due diligence obligations, which is to ensure that certain commodities and products sold in the EU or exported from the EU are deforestation-free. This includes products made from cattle, wood, cocoa, soy, palm oil, coffee, rubber, and some of their derived products.

Source: European Council (EU deforestation law: Council agrees to extend application timeline - Consilium)

EU watchdog to clarify ESG fund naming rules after backlash

On October 11, 2024, the European Securities and Markets Authority (ESMA) announced it is considering modifications to its new naming rules for sustainable investment funds, set to take effect on November 21. These rules prohibit funds using terms like "green," "environmental," or "impact" from investing in fossil fuels or high-polluting companies to combat greenwashing. However, investors worry these restrictions may hinder financing for energy transition projects, as many high-emission companies contribute to renewable energy initiatives. Research from Clarity AI indicates that about 55% of regulated funds might violate these standards. Industry representatives fear these regulations could undermine confidence in sustainable investments and send negative signals to green bond issuers. ESMA has acknowledged these concerns but has not confirmed any changes. The potential impact on the green bond market remains unclear, as energy and utility companies represent a significant portion, having issued over $70 billion in bonds this year. The European Fund and Asset Management Association warned that excluding these companies could raise capital costs and slow energy transition efforts, highlighting ongoing tensions between regulatory measures and the practical needs of sustainable finance.

Source: Reuters Sustainable Switch

The Rio Trio – Previewing Three Upcoming COP Summits

The Conference of the Parties to the United Nations Convention on Biological Diversity (COP16) will be launched on October 21. This is the first meeting since the Montreal Global Biodiversity Framework was reached. The framework requires countries to protect and conserve 30% of land and oceans by 2030. Although the conference is an opportunity for countries to share biodiversity strategies, only 25 of the 195 countries submitted relevant plans on time. In addition, the Climate COP29 and Desertification COP16 will be held in the coming months to discuss global environmental issues. Although the Conference of the Parties is crucial to global cooperation, its process and results still face major challenges, and specific goals have not been achieved, and calls for reform are growing.

Source: ESG News (https://esgnews.com/tim-mohin-the-rio-trio-previewing-three-upcoming-cop-summits/)

Mainland China ESG trends

Inter-provincial spot market officially launched: China's power system reform reaches a new level

On October 15, the inter-provincial electricity spot market was officially put into operation, and the scope of my country's electricity market-oriented transactions was further expanded. The inter-provincial electricity spot market is an inter-provincial day-ahead and intra-day electricity transaction based on the medium- and long-term inter-provincial electricity market transactions, and is an important part of the national unified electricity market. Since the trial operation started in January 2022, after 31 months of continuous trial operation, the mechanism has been stable and orderly, and it has been officially put into operation today. So far, the trading scope has achieved full coverage of the State Grid operating area and the western Inner Mongolia region, with more than 6,000 trading entities, covering multiple types of power generation entities, and a cumulative trading volume of more than 88 billion kWh, of which clean energy electricity accounted for more than 44%. In addition, the official operation of the inter-provincial electricity spot market will also better promote the consumption of new energy. During the trial operation in the first eight months of this year, the utilization rate of new energy increased by 1 percentage point through the spot market.

Source: National Energy Administration (https://www.nea.gov.cn/2024-10/18/c_1310786781.htm)

Four departments issued the "Opinions on leveraging the role of green finance to serve the construction of a beautiful China"

On October 12, the People's Bank of China, the Ministry of Ecology and Environment, the Financial Regulatory Bureau, and the China Securities Regulatory Commission jointly issued the "Opinions on Playing the Role of Green Finance in Serving the Construction of Beautiful China", proposing 19 key measures from the aspects of increasing support for key areas, aiming to help build a beautiful China through the high-quality development of green finance. The opinions clearly state that in accordance with the requirements of coordinated promotion of carbon reduction, pollution reduction, green expansion, and growth, we should build a beautiful China construction project database around the construction of the Beautiful China pilot zone, the green and low-carbon development of key industries, the in-depth promotion of pollution prevention and control, ecological protection and restoration and other key areas, and effectively improve the accuracy of financial support.

Source: Chinese Government Website (https://www.gov.cn/zhengce/zhengceku/202410/content_6979595.htm)

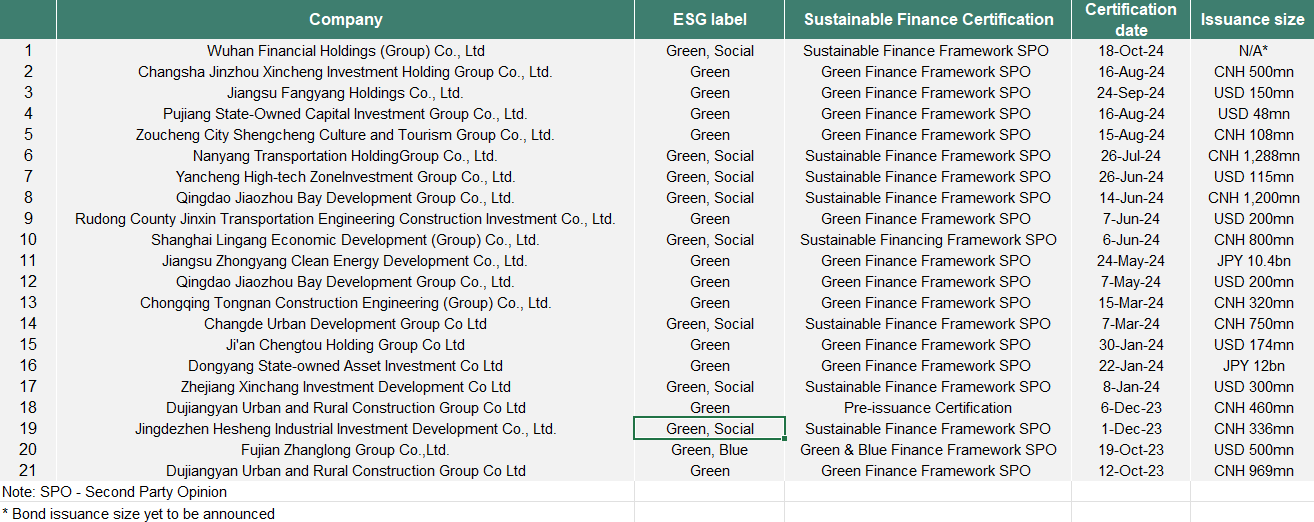

Sustainable Finance Certification Public and Completed by Lianhe Green