所屬分類:報告與見解發佈時間:2024-08-29

Hong Kong Hydrogen Energy Development Strategy

In June this year, the Hong Kong Special Administrative Region government officially released the "Hong Kong Hydrogen Energy Development Strategy" [1]. This move symbolizes the official launch of Hong Kong's strategic plan in the field of hydrogen energy. This is not only a positive response to China's "Medium and Long-term Plan for Hydrogen Energy Industry Development (2021-2035)", but also a key step towards Hong Kong's goal of achieving carbon neutrality. According to the plan, hydrogen energy is expected to play a significant role in China's energy system by 2035.

What is hydrogen energy?

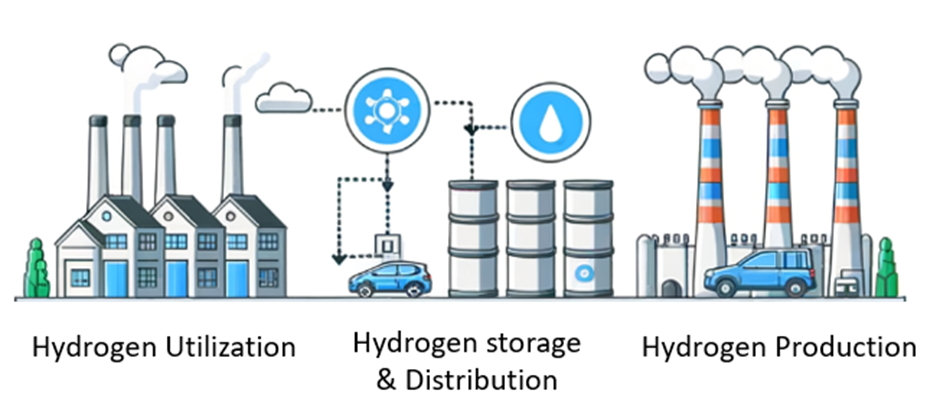

Hydrogen is a secondary energy carrier that can be generated from renewable energy sources (such as solar and wind energy) through electrolysis, and then sent to required locations to provide clean energy supply in the form of compressed storage, refrigerated storage or pipeline transportation. As a clean energy source, the only product of hydrogen combustion is water and does not release greenhouse gases such as carbon dioxide. Therefore, hydrogen energy is widely regarded as one of the key technologies to combat future climate change. Data from the International Energy Agency (IEA) shows that the development and application of hydrogen energy has the potential to significantly reduce carbon emissions in multiple industries such as industry, transportation and construction.

The importance of hydrogen to climate change

Global Hydrogen Energy Regulations and Policies

Globally, Europe is a leader in advancing hydrogen policy and regulations. The EU's Green Deal has included hydrogen in its strategy to achieve its 2050 carbon neutrality target. In addition, the EU's Carbon Border Adjustment Mechanism (CBAM) covers six major industries including steel, cement, fertilizers, aluminum and its downstream products, electricity and hydrogen, showing the importance of hydrogen energy in the EU market. In 2022, the United States increased its support for hydrogen energy in the "Inflation Reduction Act", including providing tax credits for hydrogen energy production and supporting the construction of hydrogen energy infrastructure.

Lianhe Green's analysis of the hydrogen energy development strategy and the financial market in Hong Kong

According to Lianhe Green's analysis, the energy density of hydrogen is 120 - 142 MJ/kg, and the energy density of the latest lithium battery developed on the market is expected to reach 400 -700 Wh/kg, equivalent to 1.44 MJ-2.52 MJ/kg. Based on the volume conversion, the volumetric energy density of liquid hydrogen is 9 MJ/L, which is also higher than the 1.5-2.2 MJ/L of lithium batteries. Therefore, hydrogen energy will be necessary for storage and long-distance transportation and shipping for the foreseeable future.

According to IEA forecasts, global hydrogen energy demand will increase more than three times in the next 20 years, and hydrogen energy investment will increase 10 times. Hong Kong will play a key role in this global trend, especially in financial and technological innovation. Lianhe Green will continue to pay close attention to the implementation of hydrogen energy policies and provide value analysis and suggestions to investors and policymakers. As an international institution focusing on green finance and ESG services, Lianhe Green has a positive view on Hong Kong's hydrogen energy development strategy. We expect that as the Hong Kong government continues to support and promote hydrogen energy, hydrogen energy financing products will occupy an important position in Hong Kong’s green finance. China's "Green Bond Supported Project Catalog (2021 Edition)" has listed hydrogen-related projects such as "hydrogen energy utilization facility construction and operation" as green projects, indicating that Hong Kong will follow the pace of the country and the EU and include more hydrogen energy-related projects. Industries including hydrogen energy production, storage, transportation and utilization are integrated into its sustainable financial framework.

In addition, for industries that are difficult to decarbonize, such as steel and chemicals, the application of hydrogen energy will be the key to their transformation. This is not only in line with the International Capital Markets Association ’s (ICMA) Transition Finance Principles, but also consistent with the Hong Kong Monetary Authority ’s (HKMA) support for Transition Finance, which is expected to make financial solutions utilizing hydrogen energy more market-focused and recognized.

In short, Hong Kong’s hydrogen energy development strategy not only responds to China’s hydrogen energy development plan, but also paves the way for Hong Kong to achieve its carbon neutrality goal. By promoting the development and application of hydrogen energy technology, Hong Kong is expected to take a leading position in the global green finance market and contribute to global climate action. Lianhe Green looks forward to cooperating with all walks of life in Hong Kong to jointly promote hydrogen energy technology and industrial transformation and strive to achieve a cleaner and more sustainable future.

Sustainable Finance Certification Public and Completed by Lianhe Green