所屬分類:報告與見解發佈時間:2026-02-05

1. Preface

Following the release of the Phase 1 Hong Kong Taxonomy in May 2024, the Hong Kong Monetary Authority (hereinafter referred to as the "HKMA") launched a public consultation on the prototype of Phase 2A in September 2025, seeking opinions on expanding the scope of the Taxonomy and related optimization measures. After the consultation, the HKMA comprehensively incorporated the feedback into the revisions and officially released the Hong Kong Taxonomy for Sustainable Finance (Phase 2A) (hereinafter referred to as the "Taxonomy") on January 22, 2026. This article provides an interpretation of the relevant content of the Taxonomy.

2. Introduction to New Additions in the Taxonomy

Building on the Phase 1 Hong Kong Taxonomy, the HKMA has achieved three pivotal breakthrough upgrades, marking the evolution of Hong Kong’s green framework from a “single green finance” model to a comprehensive sustainable finance framework encompassing “green + transition + climate change adaptation”. Aligned with international standards such as the Common Ground Taxonomy (CGT) while catering to local and Greater Bay Area needs, it provides more practical standards for defining sustainable assets for financial institutions, enterprises, and investors, as well as clear capital allocation guidelines for low-carbon transition. To drive the transition in Hong Kong, Mainland China, Asia, and beyond, Phase 2A not only introduces new green activities but also incorporates transition elements, including new categories for transition activities and transition measures. The specific details are as follows:

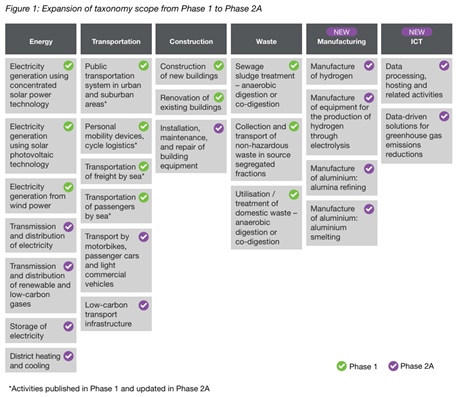

a. Expansion of Covered Sectors

Building on the four sectors defined in Phase 1—Energy, Transportation, Construction, and Waste—Phase 2A introduces two new sectors: Manufacturing, and Information and Communications Technology (ICT), expanding the total number of covered sectors from 4 to 6. These two newly added sectors are generally regarded as carbon-intensive or high-energy-consuming industries. Their development models and transition pathways have a pivotal impact on the overall socio-economic decarbonisation process, which is the core consideration behind this sector expansion.

b. Expansion of Economic Activities

The number of economic activities has increased from 13 to 25. It has further deepened coverage of two key carbon-emitting sectors—Energy and Transportation—and updated the technical standards for certain economic activities defined in Phase 1.

Source: Hong Kong Taxonomy for Sustainable Finance (Phase 2A)

c. Expansion of Environmental Objectives

Phase 1 focused on establishing substantial contribution criteria for the environmental objective of “climate change mitigation”, which will remain a priority in Phase 2A. Rising global temperatures have already caused widespread climate impacts, and the urgency for communities, industries, and countries to adapt to climate change and address escalating physical risks continues to grow. Therefore, Phase 2 introduces a new environmental objective: “climate change adaptation”. This addition underscores the need to effectively manage physical climate risks associated with extreme weather events while helping sectors enhance climate resilience.

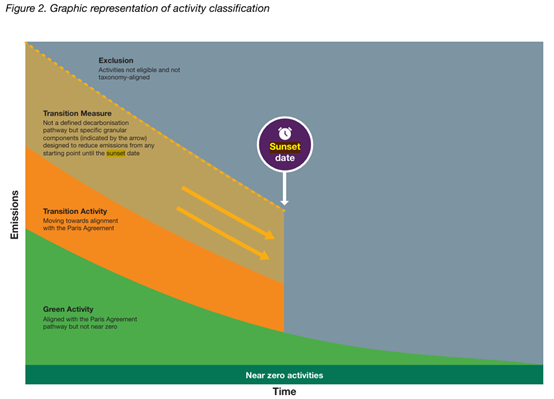

d. Introduction of Transition Concepts

Phase 2A of the Taxonomy expands its classification logic beyond solely identifying “Green Activities” aligned with the Paris Agreement’s 1.5°C pathway, establishing a dual-track system where green and transition activities, as well as their corresponding measures, operate in parallel. For the first time, the Taxonomy incorporates the definition of “transition” as a supplement to the “green” definition.

The transition category covers not only carbon-intensive activities that align their operational models with the 1.5°C temperature control pathway through decarbonisation and ultimately achieve net-zero emissions by 2050, but also activities or measures that can substantially reduce greenhouse gas emissions in the short term—even if such activities or measures may not ultimately meet the Green criteria. Meanwhile, the Taxonomy clearly identifies transition activities and measures across various sectors, setting explicit requirements for mid-term carbon reduction targets, supporting measures, transition timeframes, and other aspects to guide capital flows into these areas.

The introduction of the transition category incorporates both temporal and pathway dimensions, shifting the classification logic from “result-oriented” to “process-oriented”. It does not require transition activities to immediately meet the 1.5°C target; instead, it mandates that their emission intensity converges within a predefined future timeframe. This time constraint can reduce the space for greenwashing and provide the market with a predictable transition pathway.

Key Principles for Transition

· Transition applies only to activities with limited or no low-carbon alternatives to decarbonise. Transition should guide the decarbonisation of activities that may currently be highly emitting, but are still necessary in the long-term. This includes hard-to-abate steel and cement manufacturing activities.

· Transition requires demonstrable progress. A suitable level of reduction in emissions intensity and/or an increase in energy efficiency to show steady improvement and growing alignment with Green criteria must be demonstrated.

· Transition is time-bound and not a permanent state. A defined endpoint, referred to as the sunset date, must be set. By this date, all activities must either fully meet Green criteria or be deemed non-aligned with the Taxonomy.

· Transition focuses on existing infrastructure. Transition should primarily apply to existing infrastructure and activities, rather than new developments. This approach prevents carbon lock-in and ensures that the development and deployment of low-carbon alternatives are not hindered.

Source: Hong Kong Taxonomy for Sustainable Finance (Phase 2A)

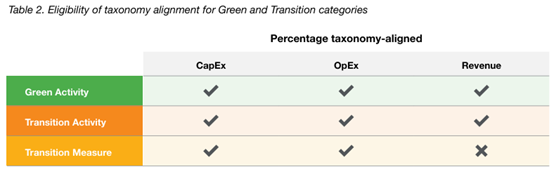

e. The role of the Taxonomy in Market Participants’ Reporting

Reporting for alignment is a key mechanism in the Taxonomy that regulates market participants' disclosure of the alignment between their economic activities and sustainable standards. Its core objective is to ensure the transparency and verifiability of sustainable finance activities, prevent greenwashing risks, and provide a basis for capital to flow accurately to compliant projects through unified and clear reporting rules.

The figure below is a critical tool for determining whether different sustainable activities meet the Taxonomy’s requirements at the financial indicator level. It focuses on financial dimension classification—specifically clarifying which of the three core financial indicators (capital expenditures, operational expenditures, and revenue) can be recognized as "Taxonomy-aligned items" and which should be excluded among the three activity categories: Green Activities, Transition Activities, and Transition Measures.

Among them, Transition Measures only represent costs, referring to the R&D, construction, or upgrading of certain emission reduction technologies or equipment. They cannot generate independent revenue and therefore do not involve revenue.

Source: Hong Kong Taxonomy for Sustainable Finance (Phase 2A)

The value of this table needs to be further materialized through “quantitative metrics” and “third-party verification” to achieve the transparency and traceability of reporting for alignment, thereby providing solid standard support for Hong Kong to consolidate its status as an international green finance hub.

3. Blue Eligible Activities and Indicators for Blue-related Activities

The release of the Taxonomy is a core initiative for Hong Kong to implement the Climate Action Plan 2050 and consolidate its status as an international green finance hub. In formulating standards, the Taxonomy strikes a balance between “international alignment” and “local customization”, which not only ensures the compatibility of cross-border capital flows but also enhances the feasibility of market implementation:

a. International Synergy: Fully aligned with the Paris Agreement’s 1.5°C temperature control target and compatible with frameworks such as the CGT and the EU Taxonomy. For instance, internationally accepted standards are adopted for lifecycle emission accounting methodologies of hydrogen, reducing compliance costs for cross-border green investment and financing.

b. Local Adaptability: Fully considers the industrial characteristics and climate risks of Hong Kong and the Greater Bay Area. For example, tailored transition thresholds are set for aluminium smelting, taking into account the Chinese Mainland’s status as the world’s largest aluminium producer. Addressing Hong Kong’s concentration of data centres, a threefold indicator system—encompassing Power Usage Effectiveness (PUE), Water Usage Effectiveness (WUE), and Global Warming Potential (GWP) of refrigerants—is established to meet the sustainable development needs of high-density cities.

c. Technological Forward-looking: Incorporates emerging areas such as hydrogen production, low-carbon retrofitting of electrolytic aluminium, and AI-powered carbon management software into its standards. It not only caters to the transition needs of “hard-to-abate” sectors but also guides capital towards future low-carbon technologies, reserving policy space for industrial upgrading.

d. Improved Policy Tool System: The Taxonomy currently operates on a “voluntary adoption” principle, but explicitly states that future exploration will be conducted to integrate it into banking supervisory policies, laying the foundation for the subsequent implementation of regulatory measures.

Lianhe Green Insights:

The release of the Taxonomy is not only an iterative upgrade of Hong Kong’s sustainable finance policies, but also establishes a classification standard system characterized by “international compatibility, local adaptability, and strong practicality”. Its core value lies in two aspects: on the one hand, it provides an Asian model of “balancing development and emission reduction” for global sustainable finance; on the other hand, it creates unique advantages for Hong Kong to align with the Mainland’s “dual carbon” goals and attract global green capital. With the subsequent sector expansion and regulatory implementation, the Taxonomy will further guide capital towards genuine and effective sustainable economic activities, helping Hong Kong become a “super-connector” linking green finance between the East and the West, and injecting lasting momentum into the low-carbon transition of the region and even the world.

For the full document, please refer to the link below: 香港可持續金融分類目錄 (第2A階段) 附件: 香港可持續金融分類目錄 (第2A階段)