With the growing global emphasis on sustainable finance, the quality of corporate ESG disclosures, particularly climate-related information, has become a critical factor in determining a company’s competitiveness in capital markets. The Hong Kong Stock Exchange (HKEX) officially implemented its Guidance for Climate Disclosures on January 1, 2025, mandating listed companies to provide more transparent, comparable, and consistent climate-related disclosures. Concurrently, the International Capital Market Association (ICMA), in its Climate Transition Finance Handbook (2023), stipulates that companies seeking to issue transition finance instruments, such as transition bonds, must disclose a clear, credible, and verifiable climate transition strategy. The convergence of these two frameworks provides companies with a well-defined pathway to meet market expectations for transition finance while mitigating the risk of greenwashing.

When issuing transition bonds, companies must not only adhere to the principles governing green bonds but also comply with the four core elements outlined in ICMA’s Climate Transition Finance Handbook. This article systematically examines these core elements, outlines the key requirements for transition bond issuance, and analyzes the alignment between HKEX’s climate disclosure requirements and ICMA’s transition finance framework. Furthermore, it explores how companies can enhance transparency and credibility through high-quality climate disclosures, thereby facilitating the successful issuance of transition bonds and strengthening investor confidence in their transition strategies.

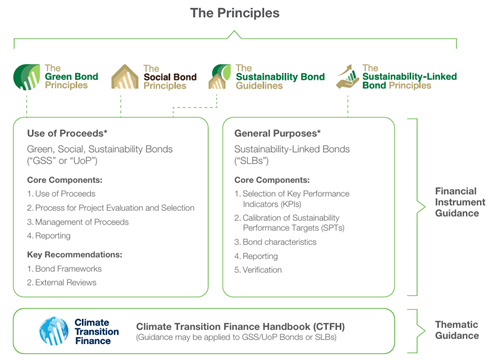

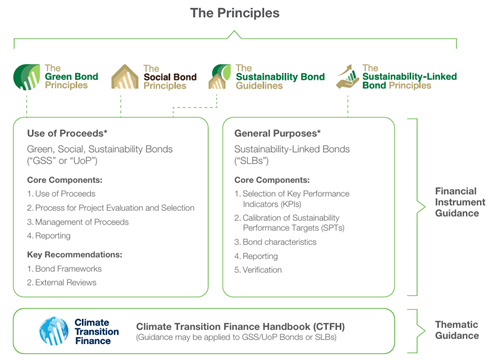

Source: ICMA's Green Bond Principles

Element 1. Issuer’s climate transition strategy and governance

ICMA Requirements

ICMA emphasizes that climate transition financing must be based on a clear climate transition strategy and governance framework, including:

- Board and management oversight to ensure the effective implementation of the climate strategy.

- Long-term greenhouse gas (GHG) reduction targets aligned with the 1.5°C pathway under the Paris Agreement.

- Short-term and mid-term climate transition targets, with a clearly defined implementation roadmap.

- Capital expenditure (CapEx) plans demonstrating how financial resources will support the low-carbon transition.

- Incorporation of climate-related information into the company’s annual reports, sustainability reports, or statutory filings, ensuring transparency for investors.

Corresponding Requirements from HKEX

- Companies must disclose board oversight of ESG matters, including how climate-related risks and opportunities are managed.

- Companies are required to formulate a climate change strategy and explain how climate considerations are integrated into business decision-making.

- Disclosure of the climate governance framework is required to ensure management accountability in executing the climate strategy.

Enhancing Compliance to Meet ICMA Requirements

- Supplement with a specific climate transition roadmap, not only addressing risk management but also detailing how the business model will be adjusted to achieve decarbonization.

- Provide a detailed CapEx plan, demonstrating investment in low-carbon technologies to avoid greenwashing risks.

- Obtain independent reviews or certifications to enhance investor confidence in the credibility of the transition strategy.

Element 2. Business model environmental materiality

ICMA Requirements

ICMA states that transition financing should directly support the decarbonization of a company’s core business and requires:

- Identification of key business activities with the most significant environmental impacts and strategies to reduce carbon emissions.

- Disclosure of Scope 1, Scope 2, and Scope 3 carbon emissions, ensuring comprehensive emissions data.

Corresponding Requirements from HKEX

- Companies must assess how their business model is affected by climate change, including physical risks and transition risks.

- Emphasis on climate-related financial disclosures to help investors understand how companies are addressing climate challenges.

- Mandatory disclosure of Scope 1 and Scope 2 greenhouse gas emissions for listed companies, with a phased approach toward mandating Scope 3 emissions disclosure for large corporations to enhance transparency in supply chain carbon footprints.

Enhancing Compliance to Meet ICMA Requirements

- Provide detailed carbon emissions data, particularly Scope 3 emissions (supply chain), to ensure data completeness.

- Identify eligible projects or key indicators related to climate change mitigation, ensuring that emissions reductions are central to the company’s core activities or that the company diversifies into new low-carbon business activities to enhance its transition strategy.

Element 3. Climate transition strategy and targets to be science-based

ICMA Requirements

ICMA emphasizes that corporate emission reduction targets must be based on industry benchmarks or scientific foundations (Science-Based Targets, SBTs) and requires:

- Long-term targets aligned with the 1.5°C climate pathway, and at minimum, well below 2°C.

- Short- and mid-term targets that conform to industry benchmarks and are supported by scientific evidence.

- Disclosure of historical carbon emissions data, including baseline years and calculation methodologies, ensuring data verifiability.

- Regular updates on emission reduction progress, subject to independent review or certification.

Corresponding Requirements from HKEX

- Companies must disclose climate scenario analysis to assess their resilience under different climate change pathways.

- Companies are required to set climate-related targets, including emission reduction goals, but there is no mandatory requirement for science-based methodologies.

Enhancing Compliance to Meet ICMA Standards

- Adopt sector-specific or SBTi-certified reduction targets, ensuring alignment with scientific methodologies.

- Disclose short-term (3 years), mid-term (5–10 years), and long-term (10+ years) decarbonization pathways, along with concrete implementation roadmaps.

- Obtain third-party verification of emissions data, strengthening the credibility of transition plans and reducing greenwashing risks.

Element 4. Implementation transparency

ICMA Requirements

ICMA mandates that companies must regularly disclose the implementation progress of their transition plans and requires:

- Disclosure of fund allocation, demonstrating investments in low-carbon technologies or business transformation.

- Reporting on capital expenditures and their contribution to GHG emissions reduction, supported by quantitative data.

- Transparent updates on transition plan progress, including milestones and interim targets.

- Independent reviews and certifications, enhancing investor confidence.

Corresponding Requirements from HKEX

- Companies must disclose the financial impact of climate change, ensuring that investors understand how they are addressing climate-related risks.

- Emphasis on ESG data transparency, with recommendations for independent review and verification.

Enhancing Compliance to Meet ICMA Requirements

- Publish regular reports on fund allocation, explicitly detailing the use of transition financing.

- Provide specific carbon reduction data, demonstrating how capital expenditures facilitate the company’s low-carbon transition.

- Undergo independent third-party reviews, improving market recognition and credibility of the corporate transition strategy.

HKEX + ICMA Transition Finance Framework = The Key to Successfully Issuing Transition Bonds

While the HKEX climate disclosure framework provides companies with a strong ESG foundation, successfully issuing transition bonds requires adherence to the ICMA Transition Finance Framework to ensure that corporate low-carbon strategies are scientifically robust, transparent, and actionable.

Meeting HKEX Requirements ≠ Eligibility to Issue Transition Bonds

To issue transition bonds, companies must:

- Set industry-specific and science-based emission reduction targets, ensuring alignment with the 1.5°C pathway.

- Provide a detailed capital expenditure (CapEx) plan, ensuring that raised funds are exclusively allocated to the low-carbon transition.

- Ensure that bonds with designated use-of-proceeds comply with domestic or international transition finance taxonomies.

- Undergo third-party audits to enhance market credibility and mitigate greenwashing risks.

As global capital markets increasingly focus on low-carbon transition, companies that align with both HKEX climate disclosure requirements and ICMA’s transition finance framework will enhance their financing capabilities and gain a competitive edge in the future green economy.