所屬分類:報告與見解發佈時間:2025-01-24

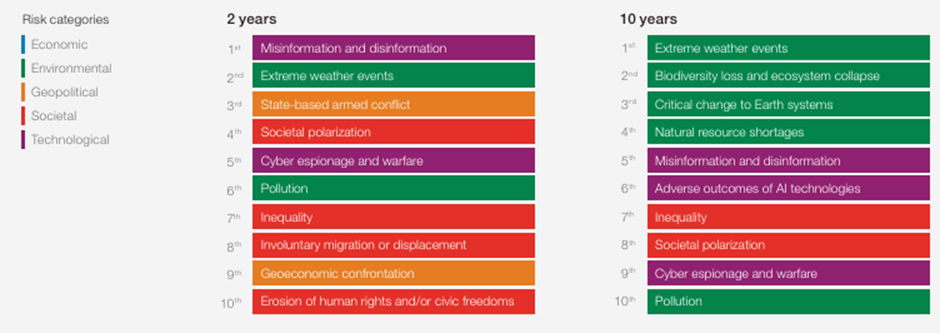

On January 15, 2025, the World Economic Forum released the 20th edition of the Global Risks Report[1], which provided an in-depth analysis of the evolving trends of today’s global risk landscape. The report highlights that rising geopolitical tensions, growing environmental crises and the breakdown of global trust are exacerbating global pressures in unprecedented ways. In the short term, State-based armed conflict, misinformation and disinformation, and Extreme weather events are listed as the most urgent risks; in the long term, environment-related risks dominate, with Extreme weather events, Biodiversity loss and ecosystem collapse and Critical changes to the Earth systems are particularly prominent.

Lianhe Green believes that the 2025 Global Risks Report further validates the importance of climate change and environment-related issues, which will continue to be at the core of global concern in the medium to long term. The following is an in-depth interpretation of the report by Lianhe Green analyst team, along with specific analyses and insights on climate change, green finance, and corporate sustainable development:

Climate change is a long-term important issue

The 2025 Global Risks Report proves that climate change and related environmental risks are still a focus of global concern:

· Long-term dominance: Environmental risks occupy several important positions in the risk rankings for the next decade, with Extreme weather events ranking first, and Pollution, Biodiversity loss and Natural resource shortages also continuing to receive attention. This demonstrates that the physical impacts of climate change and the ripple effects on ecosystems pose profound challenges to the global economy and society, both in the short and long term.

Source: World Economic Forum’s Global Risks Report 2025

· Past trends verify the future: According to the data from the 2019 Global Risks Report below, as of 2011, climate change-related issues have always been at the forefront of long-term risks. This shows that regardless of short-term fluctuations in geopolitics or economic cycles, climate change remains a core challenge that cannot be ignored.

Source: World Economic Forum’s 2019 Global Risks Report

Lianhe Green Insights and Analysis

At the same time, although geopolitical tensions and energy price fluctuations have caused some funds to flow out of the ESG sector, the Lianhe Green analyst team believes that this phenomenon is short-lived. In the long term, the importance that governments, businesses, and financial institutions attach to climate change will remain unchanged. For example:

· Although the United States has withdrawn from the Paris Climate Agreement, the world is still firmly advancing decarbonization goals: although the newly elected President Donald Trump of the United States has just signed executive actions[2] to pull the United States out of the Paris Climate Agreement and promote the development of fossil fuels, many countries around the world are still firmly advancing their decarbonization goals. For example, the EU and the UK continue to advocate for the Carbon Border Adjustment Mechanism (CBAM), which aims to impose carbon taxes on imported goods to protect their markets from countries with lower carbon standards and to promote global emissions reductions.

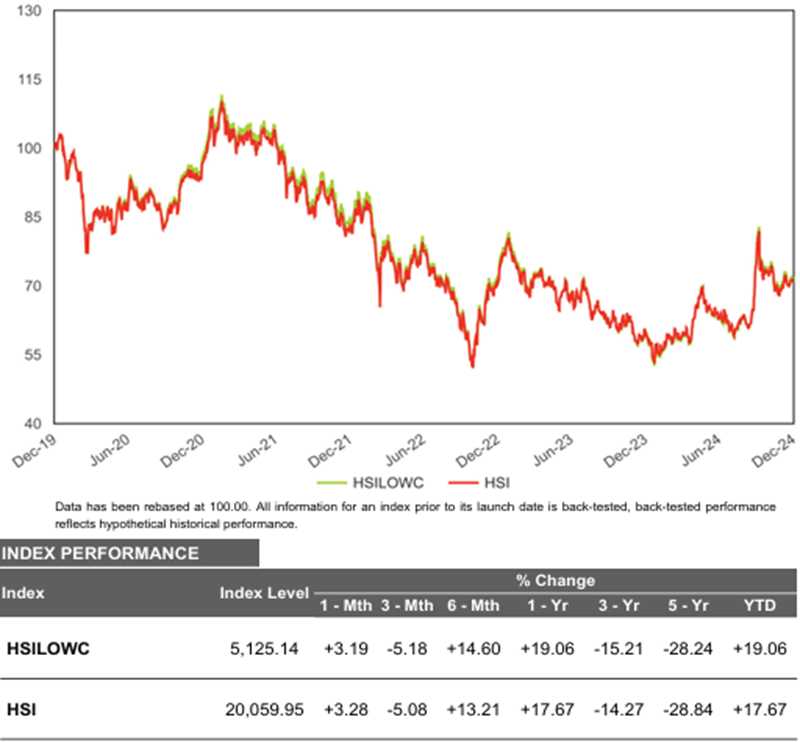

· Market performance supports that climate is a long-term issue: the Hang Seng Low Carbon Index[3] has outperformed the Hang Seng Index by 0.6% over the past five years. Although it lagged slightly behind the Hang Seng Index by 0.94% over the past three years due to geopolitical influences, it has outperformed it again in the most recent year. This demonstrates the resilience and competitiveness of low-carbon and green investments.

Source: Hang Seng Indexes Limited

Green transition opportunities for enterprises and capital markets

1. Policies and disclosure requirements promote the development of green finance:

· Over the past year, regulators in mainland China and Hong Kong have accelerated corporate disclosure requirements on climate change and sustainability. For example, the three major stock exchanges in Beijing, Shanghai and Shenzhen officially issued the Guidelines on Self-Regulation of Listed Companies – Sustainability Report [4], requiring most major listed companies on the exchanges to compulsorily disclose ESG, or environmental, social and corporate governance information, starting from 2026. The Hong Kong Stock Exchange has also updated its ESG reporting guidelines and added new climate requirements to align more closely with the International Financial Reporting Standard S2 - Climate-related Disclosures[5]. This will not only improve corporate transparency, but will also provide investors with a more adequate basis for assessing risk and return.

· The application of green finance certification and sustainable financing tools also provides companies with financial support to deal with climate change, while helping them identify risks and seize opportunities.

2. Investor demand and corporate value enhancement:

· Transparent disclosure of information related to sustainable development and climate change has become a key factor in attracting global investors and promoting cooperation. Lianhe Green recommends that companies fully understand and take advantage of this trend and enhance their market value through high-quality data disclosure.

· It is worth noting that according to Lianhe Green’s ESG rating research, among the top 95% of companies in Hong Kong by market capitalization, only about 500 companies have achieved data assurance, and the proportion is only 27%; while disclosure of Scope 3 (indirect carbon emissions) data companies only account for about 28%. This shows that there is still a significant problem of low data quality in the market, especially when investors assess the carbon emissions and climate change risks of companies and their supply chains, and the reliability is worrying.

Sustainable development as long-term development strategy

1. Sustainable performance of financial markets: The long-term performance of the Hang Seng Low Carbon Index demonstrates the potential and stability of green development. By integrating low-carbon elements into corporate operations and development plans, companies can not only promote energy conservation and emission reduction, but also enhance investor confidence in managing climate change risks.

2. Business strategies to address climate change:

o Enterprises should increase monitoring and management of climate change and carbon footprint to ensure that their supply chains are more resistant to risks.

o With the support of green financial instruments, companies can more efficiently adapt to environmental policy changes and seize the market opportunities brought by low-carbon transition.

Lianhe Green Advice

1. Businesses need to increase their awareness of the risks and opportunities associated with climate change, particularly in relation to data quality and certification. High-quality data can not only help companies assess environmental risks more accurately, but also attract more investors and partners.

2. Sustainable development requires long-term investment. Although some companies have withdrawn their sustainable development goals due to short-term pressure, we recommend that companies maintain a long-term perspective and continue to focus on green strategies and climate change responses.

3. Enterprises should improve their market competitiveness through green finance certification and information disclosure, while contributing to the realization of global climate goals.

The Global Risks Report 2025 provides us with key forward-looking insights and clarifies the importance of green finance and sustainable development for companies and investors. Lianhe Green will continue to be committed to helping companies cope with climate change-related challenges, and through innovative green financial solutions, support companies to seize opportunities in the global low-carbon transition and achieve long-term value creation.

About the Global Risks Report[6]

The Global Risks Report is the World Economic Forum’s flagship publication on global risks, now in its 20th edition. Produced by the Global Risks Initiative at the Forum’s Centre for the New Economy and Society, the report leverages insights from the Global Risks Perception Survey, which draws on the views of over 900 global leaders across business, government, academia and civil society. The report identifies and analyses the most pressing risks across immediate, short- and long-term horizons, aiming to equip leaders with foresight to address emerging challenges. It serves as a key resource for understanding the evolving global risk landscape and fostering collective action to build a more resilient future.

[2] Trump signs actions to pull US out of Paris climate agreement, intends to promote fossil fuels and mineral mining | CNN

[3] The Hang Seng Low Carbon Index aims to add low-carbon elements to the Hang Seng Index. The active weight change between the Hang Seng Low Carbon Index constituent stocks and the Hang Seng Index shall not exceed 0.5%.