所屬分類:報告與見解發佈時間:2024-12-31

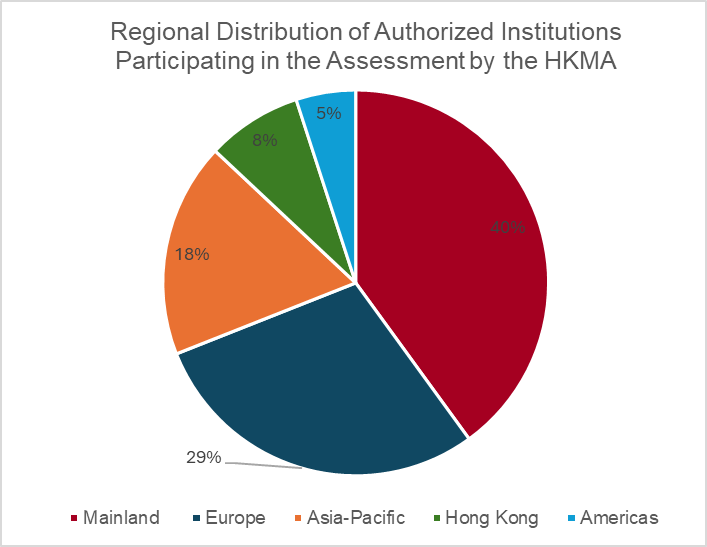

In the fourth quarter of 2023, the Hong Kong Monetary Authority (“HKMA”) conducted a second round of green assessments on the transition planning practices of 38 authorized institutions (“AIs”) and released the recent circular on “Good Practices on Transition Planning”[1] in December 2024. The HKMA also shared some good practices regarding transition planning in the market, aiming to enhance the responsibility and transparency of AIs in addressing climate change. As an important participant in sustainable finance, Lianhe Green has summarized and introduced seven key areas and provided its insights.

Source:HKMA

1. Governance

The circular noticed that the board of directors and senior management of AIs play a critical role in transition planning. They are responsible for overseeing and approving transition plans to ensure alignment with the institution’s overall strategy. Many participating banks have established dedicated governance mechanisms, such as Transition Planning Committees, to support risk management and implementation. These committees not only maintain regular communication with the Hong Kong office but also ensure that local business aligns with the group’s transition strategy. By strengthening governance structures, participating institutions can more effectively identify and manage risks associated with the transition to net zero. Additionally, regular reporting mechanisms enable senior management to stay informed about transition progress, ensuring that net zero goals are prioritized in decision-making.

2. Implementation Strategy

Participating AIs actively offer a diversified range of green and sustainable financial products to meet customer needs. Even if some institutions have not formally initiated transition planning, they still provide products like green bonds, sustainable loans, and green deposits aimed at supporting customers’ net zero goals while creating new business opportunities. Institutions adopt different approaches to meet green financing needs based on their business strategies and customer base, such as offering customized financing structures for corporate clients or providing green deposits for retail customers.

Many AIs follow internationally recognized standards to ensure compliance of their green products and seek third-party green certification to enhance credibility and market acceptance. In terms of policy, most institutions have incorporated climate risk into their financing policies, particularly in loan approvals for high-emission industries, such as ceasing to fund new coal power projects and gradually reducing related loans.

Some leading institutions have developed green rating tools to assess the environmental, social, and governance (ESG) impacts of green products and have enhanced IT infrastructure to better collect and analyze climate risk data from customers.

3. Engagement Strategy

Regarding engagement strategy, participating AIs actively enhance interaction with customers, especially those beginning to consider transition planning. They not only provide advisory services but also strive to understand customers’ transition strategies and their impacts. Many institutions proactively develop standardized tools, such as structured questionnaires, to collect information on customers' transition plans and establish processes to track customer progress, adjusting loan terms as necessary.

Furthermore, AIs actively collaborate with stakeholders, participating in industry associations or initiatives (such as the Net Zero Banking Alliance) to establish industry standards and track developments in transition planning. Leading institutions also engage with a wide range of stakeholders, including government, non-governmental organizations, and universities, to gain insights into policy and technological developments.

4. Metrics and Targets

In terms of metrics and targets, most participating AIs have set clear objectives to guide their transition processes, with the most common being net-zero targets, which encompass the institutions’ own operations and financed emissions. For financed emissions, the industry typically focuses on high-emission sectors such as power, oil and gas, coal, steel, and automotive. Additionally, many institutions have set green or sustainable financing goals, with nearly half of the participating institutions committing not to finance new coal-fired projects.

Leading participating institutions utilize a variety of metrics and targets (not limited to net-zero or emission reduction targets) to guide their transition planning and monitor climate-related risks and opportunities. These indicators include green or transition financing, exposure to high-emission industries, and exposure to high physical risks. Many institutions conduct annual reviews to ensure the relevance, effectiveness, and alignment of their goals and transition plans with strategic objectives.

These pathways are provided by recognized entities such as the International Energy Agency (IEA). Some institutions also emphasize the latest developments in monitoring methodologies and industry emission reduction pathways, adjusting industry baselines and trajectories as needed to ensure their portfolios align with the goals of the Paris Agreement.

5. Data Collection and Processing

Many participating AIs still face challenges in obtaining high-quality data to support transition planning, but leading institutions have actively taken steps to overcome these difficulties. They have established climate or ESG data strategies to enhance data management and collection efficiency, typically overseen by dedicated sustainability officers or data officers, and have set up cross-departmental working groups. Strategies include defining high-quality data standards, developing diverse data sourcing strategies (such as government data and industry databases), and improving data management systems. Additionally, institutions ensure data credibility through third-party validation and regular reviews, assessing the accuracy and currency of customer data. These measures help AIs effectively manage climate-related data to support their transition planning.

6. Scenario Analysis

Most participating AIs have conducted climate scenario analyses, primarily for risk identification, and have participated in regulatory-driven climate risk stress tests (CRST). Some institutions utilize scenario analysis to assess the alignment of their portfolios with industry pathways in order to set emission reduction targets for high-emission sectors.

Many institutions apply various climate scenarios for different purposes. For instance, scenarios from the Network for Greening the Financial System (NGFS) are used to identify transition risks, while scenarios from the Intergovernmental Panel on Climate Change (IPCC) assess physical risks. In setting goals, institutions often use scenarios from the International Energy Agency (IEA) to formulate emission reduction targets for the energy sector while selecting specific scenarios for other industries. Despite using different scenario providers, institutions typically choose scenarios that align with their goals, such as achieving net-zero emissions by 2050.

7. Disclosure and Communication

Many participating AIs actively communicate their transition plans and progress to internal and external stakeholders, typically relying on industry-recognized methodologies (such as the Partnership for Carbon Accounting Financials (PCAF) standards) to calculate emissions and disclose information. Some institutions publish annual progress reports, often in the form of independent transition plans or sustainability/ESG reports, adhering to recognized frameworks. Additionally, institutions engage with governments, NGOs, and industry groups to enhance understanding of climate-related issues.

In terms of internal communication, many institutions convey their transition plans and progress to employees through training, town halls, and corporate portals. Some institutions also use podcasts and videos to provide updates on their latest goals and plans to both internal and external stakeholders. These practices enhance the transparency of transition planning and promote broader understanding and support.

Insights from Lianhe Green

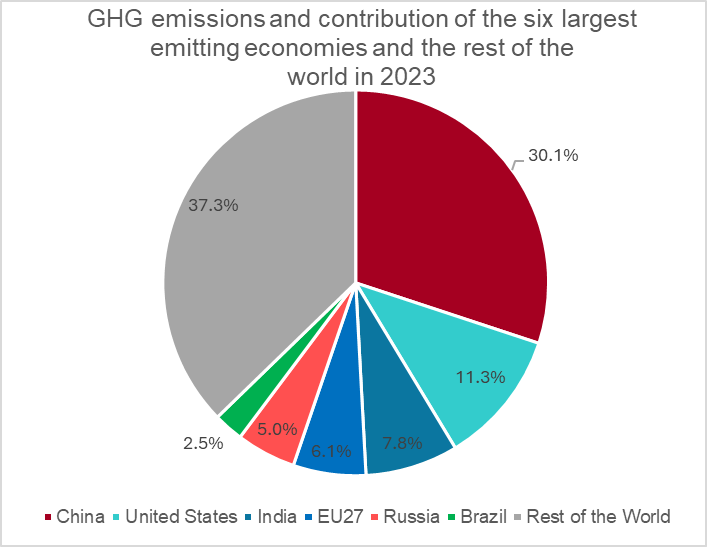

Lianhe Green believes that the HKMA’s survey has a positive impact on the industry, promoting AIs to actively offer a diverse range of green and sustainable financial products and driving the achievement of net-zero targets. At the same time, we recognize that China is the largest carbon emitter, and surrounding Southeast Asian countries, as emerging economies, are expected to see continued increase in carbon emissions due to rapid economic development. As an international financial center, Hong Kong serves Chinese and Southeast Asian enterprises, facing significant challenges but also rich opportunities in the net-zero transition of its financial sector. For example, China is internationally leading in renewable energy, electric vehicles, and battery manufacturing, providing diverse green financial products for the Hong Kong financial sector to assist companies in high-emission regions in reducing emissions.

Source:EDGAR (Emissions Database for Global Atmospheric Research) Community GHG Database

Lianhe Green as an recognised external reviewer under the GSF Grant Scheme by HKMA, can provide green certification services to borrower and assist banks in offering consulting services to businesses, promoting sustainable finance development. This includes ESG consulting, rating, disclosure, carbon accounting, and emissions reduction recommendations. Lianhe Green can also conduct on-site visits to operational locations for banks and corporates to provide ESG and carbon data verification, along with improvement suggestions. Additionally, Lianhe Green is a partner of the European Federation of Financial Analysts Societies (EFFAS) in the Chinese region, offering CESGA Chinese training courses. With an experienced team, Lianhe Green supports businesses in employee training. These measures will further promote the adoption of green finance practices in the market and drive sustainable development in the industry.