所屬分類:報告與見解發佈時間:2024-10-30

The Hong Kong Monetary Authority (HKMA) announced its Sustainable Finance Action Agenda on October 21. The Action Agenda highlights that the banking industry will play a key role in promoting low-carbon transformation and achieving the goal of net zero emissions. This Action Agenda not only emphasizes the sustainable development of banks themselves, but also requires them to take more active steps in financing.

First, the HKMA pointed out that “All banks to strive to achieve net zero in their own operations by 2030 and in their financed emissions by 2050”. This goal requires banks to develop a practical transition plan with clear emission reduction and financing targets. In the process, banks must report their transition plans to the HKMA regularly to transparently demonstrate their efforts to achieve these goals. Lianhe Green believes that the measures currently taken by Hong Kong banks to reduce the carbon intensity from electricity usage mainly include reducing electricity use, switching to renewable energy electricity, and purchasing carbon credits. Although the two power companies in Hong Kong are committed to reducing the carbon intensity of electricity, according to the Hong Kong Climate Action Blueprint 2050[1] published by the Hong Kong government, "Net-zero electricity generation: Cease using coal for daily electricity generation; increase the share of renewable energy in the fuel mix for electricity generation to 7.5 per cent to 10 per cent by 2035, and to 15 per cent subsequently". Even in 2030, a portion of the electricity will be produced from coal, and it will also rely on natural gas for power generation. According to the U.S. Energy Information Administration[2] (EIA), the carbon intensity of natural gas power generation is about 0.45g CO2/kWh. Even if banks are committed to reducing carbon emissions from their operations, each bank needs to purchase a certain amount of carbon offsets to eliminate the remaining emissions that cannot be reduced or replaced. It is foreseeable that this will assist Hong Kong's two power companies in supporting the development of renewable energy and promoting "Renewable Energy Certificates."

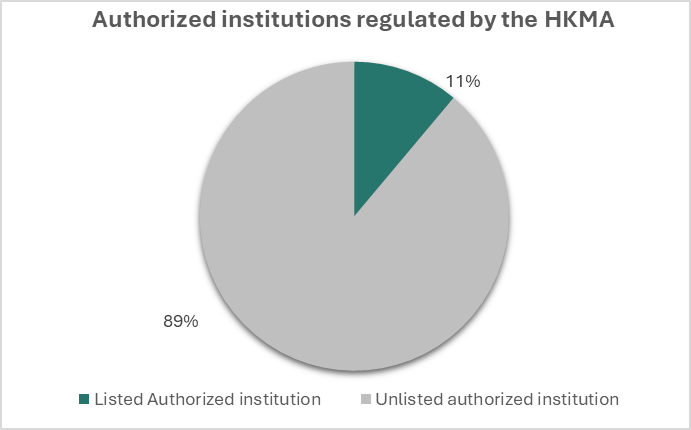

Secondly, the HKMA will provide support and guidance to help banks develop transition plans. This includes guidance on the use of tools for climate risk management, a framework for transition planning, and taxonomy for green and transition activities. Through these measures, the HKMA hopes to enhance banks' capabilities in the field of sustainable finance and ensure that they comply with international standards. In addition, the HKMA also emphasized the need to increase transparency to external investors and companies, requiring banks to provide clearer disclosures on climate-related risks and opportunities. This not only helps enhance investors’ trust in banks, but also provides the market with more consistent and relevant information to facilitate sustainable investment decisions. Lianhe Green believes that although the Hong Kong Stock Exchange required companies listed on the main board to disclose relevant climate information in accordance with the requirements of the International Sustainability Standards Board (ISSB) in April this year, analysis shows that out of the 207 authorized institutions regulated by the HKMA, only about 23 affiliated companies of authorized institutions are actually listed on the Hong Kong Stock Exchange. This means that more than 180 accredited institutions need to prepared to provide clearer disclosures on climate-related risks and opportunities[3].

In terms of investment, the HKMA will prioritize ESG (environmental, social and governance) investments and strive to achieve a net zero target by 2050. Since 2017, the weighted average carbon intensity (WACI) of Hong Kong's trading funds in public equity holdings has fallen by 46%. In order to further promote sustainable investment, the HKMA plans to continue to expand its investment scope, especially in public and private market investments that support climate transition themes. Lianhe Green believes that after regulators set quantitative targets for carbon intensity, the next step is expected to be to increase requirements for the accuracy of carbon emissions data, and companies need to prepare for accurate disclosure.

Finally, the HKMA will work to make Hong Kong a regional hub for sustainable financing. Through incentives and subsidies, more borrowers, especially those from the mainland China and the Belt and Road regions, will be encouraged to use Hong Kong to raise sustainable financing. At the same time, the HKMA will also strengthen the demonstrative effect of the Government Sustainable Bond Programme and promote the issuance of green bonds. Lianhe Green believes that with the promotion of this programme, in conjunction with the clear guidelines such as the "Hong Kong Taxonomy for Sustainable Finance" issued by the HKMA in May, it will attract more issuers or investors from different regions to come to Hong Kong for sustainable financing.

In summary, Lianhe Green believes that the HKMA's "Sustainable Finance Action Agenda" has paved the way for the development of sustainable finance in Hong Kong. Through clear goals, support measures and requirements for increased transparency, Hong Kong will be able to play a more significant role in the global sustainable finance arena and facilitate the low-carbon transformation of the economy. In the future, with the joint efforts of all parties, Hong Kong is expected to become a key hub for sustainable financing in Asia and beyond. At the same time, Lianhe Green expects that the HKMA will release more implementation details in the near future to advance the above Action Agenda.

[1] The Government of the Hong Kong Special Administrative Region announced Hong Kong's Climate Action Plan 2050

[3] Some listed banks have two related authorized institutions supervised by the HKMA, while some authorized institutions supervised by the HKMA have two related listed banks. The above statistics do not double-count the related institutions.