return

return

current location:Home

current location:Home

News and Events

News and Events

News and Events

News and Events

【ESG News】Global Trends Biweekly Newsletter Issue 27 (2025.2.10-2025.2.23)

【ESG News】Global Trends Biweekly Newsletter Issue 27 (2025.2.10-2025.2.23)

return

return

current location:Home

current location:Home

News and Events

News and Events

News and Events

News and Events

【ESG News】Global Trends Biweekly Newsletter Issue 27 (2025.2.10-2025.2.23)

【ESG News】Global Trends Biweekly Newsletter Issue 27 (2025.2.10-2025.2.23)

category:News and EventsRelease time:2025-02-25

Hong Kong China ESG trends

SFC forges consensus with regional counterparts on regulatory roadmap for sustainability, technology and investor protection

The Securities and Futures Commission (SFC) spearheaded dialogues among Asia-Pacific securities regulators at the regional committee meetings of the International Organization of Securities Commissions (IOSCO), reaching common ground on the future pathways to tackle wide-ranging capital market issues. Financial authorities and senior regulators from Europe and Asia Pacific discussed the latest developments in financial supervision and regulation for digitalisation, fintech and sustainable finance.

Source: https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=25PR22

International ESG trends

EU Plans to Walk Back Key Planks of Toughest ESG Legislation

The European Union’s executive arm is proposing that the bloc amend eight main points in the scope of the Corporate Sustainability Due Diligence Directive, according to a draft proposal seen by Bloomberg. The changes span everything from limiting corporate obligations to monitor potential ESG breaches in supply chains, to reducing potential fines.

The move follows intense pressure on the bloc — both from within and outside Europe — to rein in a piece of legislation whose early design was intended to expose companies to legal liability if they failed to purge their value chains of ESG violations. Companies in the EU have warned that complying with CSDDD will make it harder to compete with the US and Asia. In France, officials have gone so far as to ask that CSDDD be shelved. Incoming US commerce secretary has considered deploying “trade tools” to ensure American companies exposed to the EU market aren’t expected to comply with CSDDD.

The commission is due to unveil its proposal for the so-called omnibus legislation on Feb. 26. Aside from CSDDD, the omnibus process will also look at ways to simplify the EU’s Corporate Sustainability Reporting Directive and the Taxonomy Regulation.

The proposal is already drawing criticism from civil society groups that had been lobbying for the EU to stick to the original principles of CSDDD.

Lianhe Green Insight:

The EU's proposed amendment to the Corporate Sustainability Due Diligence Directive (CSDDD) is essentially a fragile balance between the pressure of global competition and the goal of sustainable development. It reflects the EU's compromise on the competitiveness of its internal industries. Faced with the blockade of American and Asian companies and opposition from internal member states, policymakers have to "loosen up" to ease the survival anxiety of companies. In particular, the tough stance of France and other countries and the potential threat of trade retaliation from the United States have further forced the EU to soften its stance. However, this compromise may come at the expense of the effectiveness of ESG governance.

This contradiction may weaken the EU's voice in the formulation of global ESG standards and may even trigger a "race to the bottom" - if economies such as the United States take the opportunity to implement more relaxed rules, the sustainable transformation of the global supply chain will face greater resistance. In the long run, the real solution may not be to relax regulation, but to promote international coordinated legislation, share corporate compliance costs through multilateral mechanisms, and avoid sustainable governance becoming a victim of geo-economic games.

Deal on new EU rules to reduce textile and food waste

Parliament and Council reached a provisional agreement on new measures to prevent and reduce waste from food and textiles across the EU.

Negotiators agreed to introduce binding food waste reduction targets to be met at national level by 31 December 2030: 10% in food processing and manufacturing and 30% per capita in retail, restaurants, food services and households. These targets would be calculated in comparison to the amount generated as an annual average between 2021 and 2023. Following Parliament’s request, EU countries would have to take measures to ensure that economic operators having a significant role in the prevention and generation of food waste (to be identified in each country) facilitate the donation of unsold food that is safe for human consumption.

According to the deal, EU countries would have to establish producer responsibility (EPR) schemes, through which producers that make textiles available in an EU country would have to cover the costs for their collection, sorting and recycling, 30 months after the entry into force of the directive. These provisions would apply to all producers, including those using e-commerce tools and irrespective of whether they are established in an EU country or outside the EU. Micro-enterprises would need to comply with the EPR requirements 12 months later.

Lianhe Green Insight:

The EU's new agreement on textile and food waste shows its pragmatic shift in circular economy legislation, but the effectiveness of implementation and the underlying contradictions remain to be tested. Through mandatory binding targets (10% reduction in food processing waste, 30% reduction in consumer waste) and producer responsibility coverage, the EU attempts to force industry transformation through market mechanisms - especially by incorporating non-EU e-commerce into the textile recycling cost-sharing system, breaking through the geographical boundaries of traditional regulation, and may reshape the sustainable standards of the global fast fashion and food supply chains.

Mainland China ESG trends

Ministry of Finance Releases “The People's Republic of China Sovereign Green Bond Framework”

To explore opportunities for issuing sovereign green bonds in overseas markets, the Ministry of Finance, guided by Xi Jinping Thought on Ecological Civilization and with reference to domestic and international best practices, has formulated "The People's Republic of China Sovereign Green Bond Framework" and will now release it to the public. On the basis of this Framework, the Ministry plans to issue China's sovereign green bonds abroad in the future to enrich the high-quality green bond products in the international market and attract more international capital for domestic green and low-carbon development, contributing to the advancement of green finance and continuously promoting the building of a Beautiful China.

Source: https://www.mof.gov.cn/en/news/mn/202502/t20250220_3958750.htm

Notice on the issuance of the "Catalogue of Low-Carbon Technologies for National Key Promotion (Fifth Edition)"

In order to implement the spirit of the 20th National Congress of the Communist Party of China and the Second and Third Plenary Sessions of the 20th Central Committee, vigorously support the innovation and promotion of low-carbon technologies, and cultivate and develop new quality productivity, the Ministry of Ecology and Environment, together with the Ministry of Industry and Information Technology, the Ministry of Housing and Urban-Rural Development, the Ministry of Transport, and the Ministry of Agriculture and Rural Affairs, carried out the collection and screening of low-carbon technologies in accordance with the relevant requirements of the "National Key Low-Carbon Technology Collection and Promotion Implementation Plan" and compiled the " Catalogue of Low-Carbon Technologies for National Key Promotion (Fifth Edition)", including 103 low-carbon technologies in 5 key directions.

Source: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk06/202502/t20250212_1102102.html

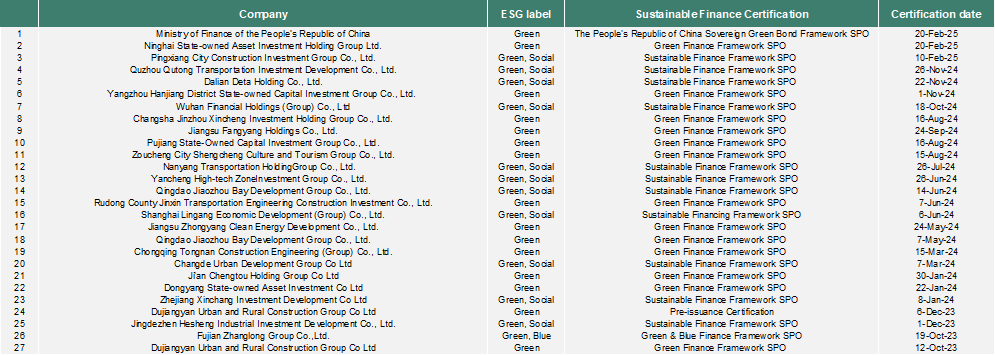

Sustainable Finance Certification Public and Completed by Lianhe Green