return

return

current location:Home

current location:Home

News and Events

News and Events

News and Events

News and Events

【ESG News】Global Trends Biweekly Newsletter Issue 21 (2024.11.18-2024.12.1)

【ESG News】Global Trends Biweekly Newsletter Issue 21 (2024.11.18-2024.12.1)

return

return

current location:Home

current location:Home

News and Events

News and Events

News and Events

News and Events

【ESG News】Global Trends Biweekly Newsletter Issue 21 (2024.11.18-2024.12.1)

【ESG News】Global Trends Biweekly Newsletter Issue 21 (2024.11.18-2024.12.1)

category:News and EventsRelease time:2024-12-02

Hong Kong China ESG trends

Guidance to Asset Managers Regarding Due Diligence Expectations for Third-party ESG Ratings and Data Products Providers

The Securities and Futures Commission’s (SFC) observed from its previous fact-finding exercise1 that asset managers generally engage ESG ratings and data products providers (ESG service providers) and use the products of these providers to facilitate their investment decision-making and risk management processes. The exercise also highlighted common concerns raised by asset managers regarding ESG service providers’ data quality, transparency and conflicts of interest management.

On 25 Nov 2024, the SFC published Circular to Intermediaries. Pursuant to General Principles 2 and 3 of the Code of Conduct, asset managers are generally expected to exercise due skill, care and diligence when engaging third-party service providers and ensure that such resources are adequate and effective for the proper performance of their business activities. To meet such regulatory expectations, asset managers should conduct reasonable due diligence and ongoing assessments on third-party ESG service providers.

To address the common concerns discussed in Paragraph 1, the due diligence and ongoing assessments should allow asset managers to reasonably understand the ESG products provided by the third-party ESG service providers. These include how such products are produced (eg, the source and timeliness of the underlying information used, any use of estimates, methodologies applied, and the criteria and approach for assessing the covered entity), limitations and the purposes for which the product is being used

Source: Circular to Intermediaries Guidance to asset managers regarding due diligence expectations for third-party ESG ratings and data products providers | Securities & Futures Commission of Hong Kong

EFFAS Groundbreaking Recognition by HKMA

November 25th, 2024 — EFFAS announced a landmark achievement for its Certified ESG Analyst (CESGA) qualification. The Hong Kong Monetary Authority (HKMA) has granted CESGA three modular exemptions under its Enhanced Competency Framework on Green and Sustainable Finance (ECF-GSF). These exemptions span both QF Level 4 (Modules 1 & 2) and Level 5 (Module 7), positioning CESGA as the only qualification in Hong Kong to achieve such a distinction.

Source: https://effas.com/effas-groundbreaking-recognition-by-hkma/

International ESG trends

Environmental, Social and Governance (ESG) ratings: Council Greenlights New Regulation

On 19 November 2024, the European Council adopted a new regulation on environmental, social and governance (ESG) rating activities. The new rules aim at making rating activities in the EU more consistent, transparent and comparable in order to boost investors’ confidence in sustainable financial products. The new rules aim to strengthen the reliability and comparability of ESG ratings by improving the transparency and integrity of the operations that ESG ratings providers carry out and by preventing potential conflicts of interest.

In particular, ESG rating providers established in the Union will need to be authorised and supervised by the European Securities and Markets Authority (ESMA). They will have to comply with transparency requirements, in particular with regard to their methodology and sources of information. ESG rating providers established outside the Union that wish to operate in the Union, will need to obtain an endorsement of their ESG ratings by an EU authorised ESG rating provider, a recognition based on a quantitative criterion, or be included in the EU registry of ESG rating providers on the basis of an equivalence decision.

Source: Environmental, social and governance (ESG) ratings: Council greenlights new regulation - Consilium

COP29 climate talks end with $300 billion annual pledge, Guterres calls deal a ‘base to build on’

After two weeks of intense negotiations, delegates at COP29, formally the 29th Conference of Parties to the UN Framework Convention on Climate Change (UNFCCC), agreed to provide at least $300 billion funding annually, with an overall climate financing target to reach “at least $1.3 trillion by 2035”.

Countries also agreed on the rules for a UN-backed global carbon market. This market will facilitate the trading of carbon credits, incentivizing countries to reduce emissions and invest in climate-friendly projects.

While some delegations applauded the deal, many from the developing world, including Bolivia and Nigeria, expressed their deep disappointment at what they argued was an “insultingly low” financing target and that the agreed text failed to significantly build on an agreement last year at COP28 in Dubai calling for nations to “transition away from fossil fuels”.

Source: https://news.un.org/en/story/2024/11/1157416

Mainland China ESG trends

China's sustainable development level continues to improve

The China Sustainable Development Indicator System 2024 Report, released at a China Pavilion event during the ongoing 29th Conference of the Parties to the United Nations Framework Convention on Climate Change, tracks the sustainability progress of China and compares the sustainability performance of Chinese cities and provinces.

According to the Total Sustainability Index developed by the report, China's score rose from 57.1 in 2017 to 84.4 in 2024, representing a cumulative increase of 46.8 percent.

Since 2017, the five indicator categories of economic development, social welfare, environmental resources, consumption and emissions, and environmental management, have shown an upward trend, the report said.

Source: China's sustainable development level continues to improve: report-Xinhua

China's Ministry of Industry and Information Technology: Accelerating the Cultivation of Green, Low-Carbon Emerging Industries

November 29, the Ministry of China's Ministry of Industry and Information Technology Minister, leader of Carbon peak and Carbon Neutrality Work Leading Group Jin Zhuanglong presided over the Carbon Neutrality Work Leading Group meeting, summarized the status of Carbon peak and Carbon Neutrality work in the industrial field, and studied the next key tasks.

The meeting emphasized the need to anchor the “Carbon peak and Carbon Neutrality” goal vision, adhere to the system concept, innovation-driven, accelerate the green and low-carbon transformation of industry. It is necessary to strengthen top-level planning, carry out the pre-study of the “Fifteenth Five-Year Plan” industrial green and low-carbon development plan, and implement green and low-carbon development actions for the manufacturing industry; strengthen standard leadership, and formulate the carbon footprint accounting standards for key industrial products; strengthen the implementation of the tasks, promote the energy-saving and carbon-reducing actions in tailored for sectors, and accelerate the cultivation of green and low-carbon new industries; strengthen the guarantee of elements, and accelerate the innovation of industrial green and low-carbon processes, key technology and equipment research, and the construction of public service platform.

Source: China's sustainable development level continues to improve: report-Xinhua

The General Office of the Central Committee of the Communist Party of China and the General Office of the State Council issued the Action Program for Effectively Reducing the Cost of Logistics for the Whole Society

The program requires accelerating the green transformation of logistics. Specific methods include: develop a directory of key technologies and equipment for promoting green logistics, and support the green upgrading and transformation of logistics hubs and stations, warehousing facilities and means of transportation. Carry out green logistics enterprise benchmarking and standardization actions. Support the development of carbon emission accounting and related certification in the logistics sector, and build a public service platform for logistics carbon emission calculation. Expand the application of new energy logistics vehicles in urban distribution, postal express and other fields. Studying the development path of zero-carbon emission technology for medium and heavy trucks. Continuously promote the greening, reduction and recycling of logistics packaging. Promote the establishment of a supply guarantee system for clean fuels for ships.

Source: 中共中央办公厅 国务院办公厅印发《有效降低全社会物流成本行动方案》_最新政策_中国政府网

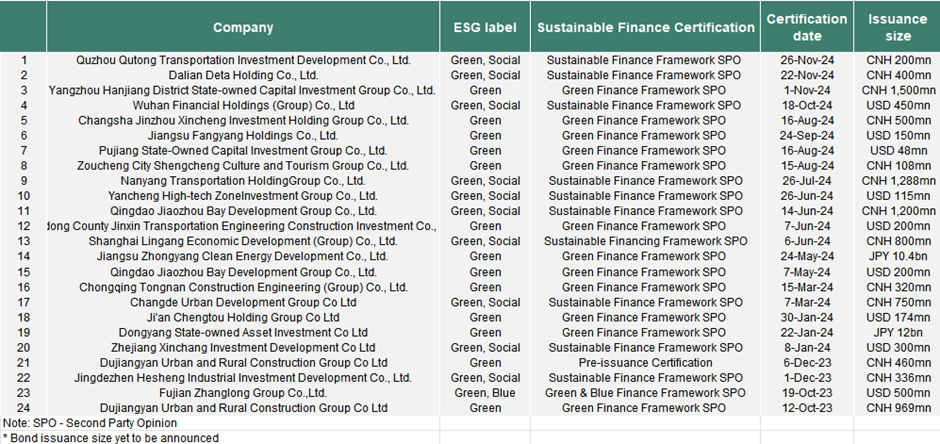

Sustainable Finance Certification Public and Completed by Lianhe Green