Trends in the Development ESG Ratings

Environmental, social and governance (ESG) ratings have become increasingly important in modern financial markets as a key tool for assessing corporate sustainability and social responsibility. It not only reflects a company's performance in environmental, social and governance, but also affects its ability to raise capital and investment attractiveness. With the increased focus on sustainability, investor demand for high-quality, transparent and reliable ESG ratings is on the rise.

In response to this demand, the European Union (EU) issued the ESG Ratings Regulation in November 2024, requiring all organizations providing ratings in the EU to follow strict standards. Meanwhile, the International Capital Market Association (ICMA) launched a voluntary Code of Conduct for ESG Ratings in Hong Kong, sponsored by the Hong Kong Securities and Futures Commission (SFC), in October 2024 to enhance market transparency. Based on the understanding of market demand and development trend, Lianhe Green launched ESG Ratings in September this year, aiming to provide ESG rating products and methodologies with transparency and integrity to the market in Mainland China and Hong Kong, thus boosting sustainable investment. At the same time, it provides independent and objective ESG rating reports to companies and issuers in need, helping their ESG performance to be recognized by international investors and thus attracting them to invest in their companies.

New EU Regulations on ESG Ratings

“REGULATION on the transparency and integrity of Environmental, Social and Governance (ESG) rating activities” was published by the European Parliament and the Council in November 2024 with the aim of improving the transparency and fairness of ESG ratings. This regulation applies to all rating agencies providing or issuing ESG ratings in the EU, regardless of their place of registration.

The main objective of the regulation is to ensure that ESG ratings are independent, comparable and systematic, and to prevent “greenwashing”, thereby enhancing investor and consumer trust and supporting the development of sustainable financial markets. The regulation requires rating agencies to adopt rigorous, systematic and transparent methodologies and to regularly review their rating criteria.

Under the new regulations, ESG rating agencies, including non-EU firms, must register with and be licensed by the EU Supervisory Authority (ESMA) to provide services in the EU. They will be subject to a number of requirements, including setting up a transparent ratings methodology, disclosing data sources, indicator weights and assumptions, avoiding conflicts of interest, ensuring the independence of the ratings department from other operations, and updating the ratings regularly to reflect the most up-to-date information. At the same time, the EU regulation on ESG ratings states that if the ESG ratings regulation in a third country fulfills EU requirements, it can be considered equivalent and compliant with ESMA standards, allowing the conduct of ESG ratings business in Europe. The main provisions of the regulation will become applicable 18 months after its entry into force, i.e. around mid-2026.

Hong Kong Code of Conduct for ESG Ratings

ICMA launched a voluntary “Hong Kong Code of Conduct for ESG Ratings and Data Products Providers”, sponsored by SFC, in October 2024, aimed at providing guidance for environmental, social, and governance rating and data product providers. The release of these guidelines coincides with the EU's introduction of ESG rating transparency regulations, emphasizing the importance of enhancing market transparency and strengthening investor trust.

The new guidelines encourage industry self-regulation, requiring suppliers to adhere to high standards of transparency and impartiality when providing ESG ratings. Specifically, suppliers must clearly disclose their rating methodologies, data sources, and potential conflicts of interest to assist investors in making informed decisions. This industry-led voluntary compliance mechanism can flexibly respond to market changes while ensuring the quality and credibility of ESG information.

At the same time, on November 25, 2024, SFC issued a circular to intermediaries, providing guidance for asset management companies on conducting due diligence for third-party ESG rating and data product suppliers[3]. This guidance includes the expectation that asset management companies consider the " Hong Kong Code of Conduct for ESG Ratings and Data Products Providers" during their due diligence and ongoing assessment. Lianhe Green believes that the voluntary code of conduct provides clear guidance for the market, helping suppliers establish compliance with the standards and enabling users to understand and execute due diligence effectively.

Overview of Lianhe Green ESG Rating Methodology International Edition

Against this backdrop, Lianhe Green, as an organization specializing in green finance and ESG services, is committed to providing high-quality ESG ratings to help companies and issuers in need attract international investors and sustainable investments. Lianhe Green's rating system takes into account environmental, social and governance factors and incorporates China's unique market dynamics and policy environment to ensure the applicability and reliability of the ratings. This ESG rating system complements the new regulations in the European Union and Hong Kong, and is designed to enhance market participants' confidence in Chinese assets. By providing transparent and unbiased ratings, Lianhe Green helps investors identify companies and projects with sustainability potential in the Chinese market, thereby facilitating the flow of capital to investments that meet their sustainable development targets.

1. ESG Rating Methodology Objectives and Characteristics

Lianhe Green's ESG ratings provide companies with an assessment of the ESG risks and opportunities associated with managing their finances. Each rating evaluates potential ESG risks, management systems and governance structures by combining an international perspective with the company's operating conditions. At the same time, it utilizes the platform of Hong Kong's international financial center to analyze major controversial issues and ESG operational risks in each country to help investors make informed decisions.

Figure 1. ESG rating methodology characteristics

Lianhe Green adheres to the principle of openness and transparency, and a more detailed methodology can be found on the Lianhe Green webpage at Lianhe Green ESG Rating Methodology International Edition - Lianhe Green.

2. ESG Rating Insights

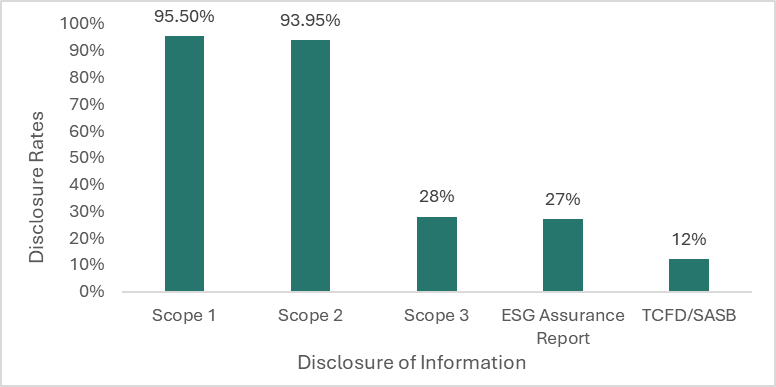

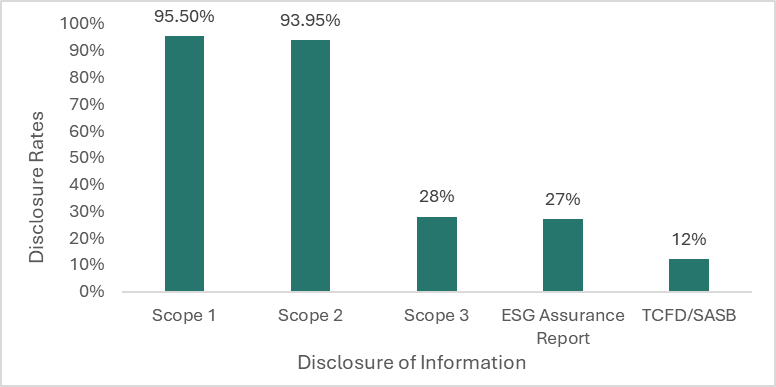

Lianhe Green utilizes an ESG rating model to provide active ratings for more than 500 listed companies in Hong Kong, covering 95% of market capitalization, and comprehensively benchmarking the performance of local, foreign and Chinese companies in Hong Kong. The ratings cover large, mid and small cap stocks, ensuring broad representation and compliance with international ESG standards. In the process of rating listed companies in 2024, Lianhe Green found that 27% of listed companies issued ESG certification reports, indicating that companies are gradually realizing the importance of ESG performance for their brand image and long-term sustainable development. 12% of companies followed the TCFD or SASB standards, which shows the international recognition of these companies' pursuit of higher standards in ESG practices. Meanwhile, in terms of GHG emissions disclosure, Lianhe Green tallied Scope 1 and Scope 2 disclosure rates of 95.5% and 93.95%, respectively, reflecting the transparency of companies in terms of direct emissions and energy-related indirect emissions. However, the disclosure rate for Scope 3 is only 28%, indicating that there is still much room for improvement in terms of the broader environmental impacts of enterprises in the supply chain and product life cycle.

Figure 2. Analysis of ESG report disclosures

Source: Lianhe Green analysis

3. Lianhe Green ESG Rating Report

Lianhe Green accepts commissions from companies or investors to conduct ESG ratings and issue corresponding ESG rating reports. Lianhe Green adopts a multi-dimensional and internationalized assessment framework to comprehensively consider the client's performance in the three core areas of environmental, social and corporate governance. Through interviews, site visits and data collection with rated companies, Lianhe Green will conduct in-depth ratings, analysis and comparisons, and provide a comprehensive ESG rating report. This initiative aims to help companies and investors grasp the sustained performance, risks and strengths of companies in the ESG field from the perspective of assessment methodologies in line with international and domestic standards.

return

return

current location:Home

current location:Home

Reports and Insights

Reports and Insights

Reports and Insights

Reports and Insights

[ESG Monthly Report] From the EU’s Regulation of ESG Ratings to Hong Kong's Voluntary Code of Conduct for ESG Ratings: Lianhe Green ESG Ratings Promote the Development of Sustainable Investment

[ESG Monthly Report] From the EU’s Regulation of ESG Ratings to Hong Kong's Voluntary Code of Conduct for ESG Ratings: Lianhe Green ESG Ratings Promote the Development of Sustainable Investment