return

return

current location:Home

current location:Home

Reports and Insights

Reports and Insights

Reports and Insights

Reports and Insights

【Methodology】Lianhe Green ESG Rating Methodology International Edition

【Methodology】Lianhe Green ESG Rating Methodology International Edition

return

return

current location:Home

current location:Home

Reports and Insights

Reports and Insights

Reports and Insights

Reports and Insights

【Methodology】Lianhe Green ESG Rating Methodology International Edition

【Methodology】Lianhe Green ESG Rating Methodology International Edition

category:Reports and InsightsRelease time:2024-11-06

1. What is ESG rating?

The ESG rating is an assessment system that measures a company's performance in terms of Environmental, Social and Corporate Governance. Typically conducted by third-party organizations, these ratings are designed to provide investors, consumers, and regulators with quantitative indicators of corporate sustainability and social responsibility. ESG ratings consider potential risks and opportunities faced by companies, including environmental impacts (e.g. greenhouse gas emissions), social responsibility (e.g. labor rights and community involvement), and corporate governance structures (e.g., board diversity and transparency). These ratings not only provide a platform for companies to demonstrate long-term value and risk management capabilities, but also provide a tool for investors to screen their investments. As the global focus on sustainability deepens, ESG ratings are becoming an important criterion in the capital markets, influencing corporate brand image and attractiveness. It is driving companies towards a more sustainable and responsible future.

2. Overview of Lianhe Green ESG Rating Methodology International Edition

2.1 ESG Rating Methodology Objective

The ESG ratings introduced by Lianhe Green provide companies with an assessment of managing financial-related environmental, social and corporate governance (ESG) risks and opportunities. Each rating assesses a company's ESG value by combining an international perspective with a company's operational profile, considering potential ESG risks, management systems and governance structures. At the same time, it utilizes the platform of Hong Kong's international financial center to analyze major controversial issues and ESG operational risks in various countries to help investors make informed investment decisions.

2.2 ESG Rating Methodology Main Characteristics

2.3 ESG Rating Framework

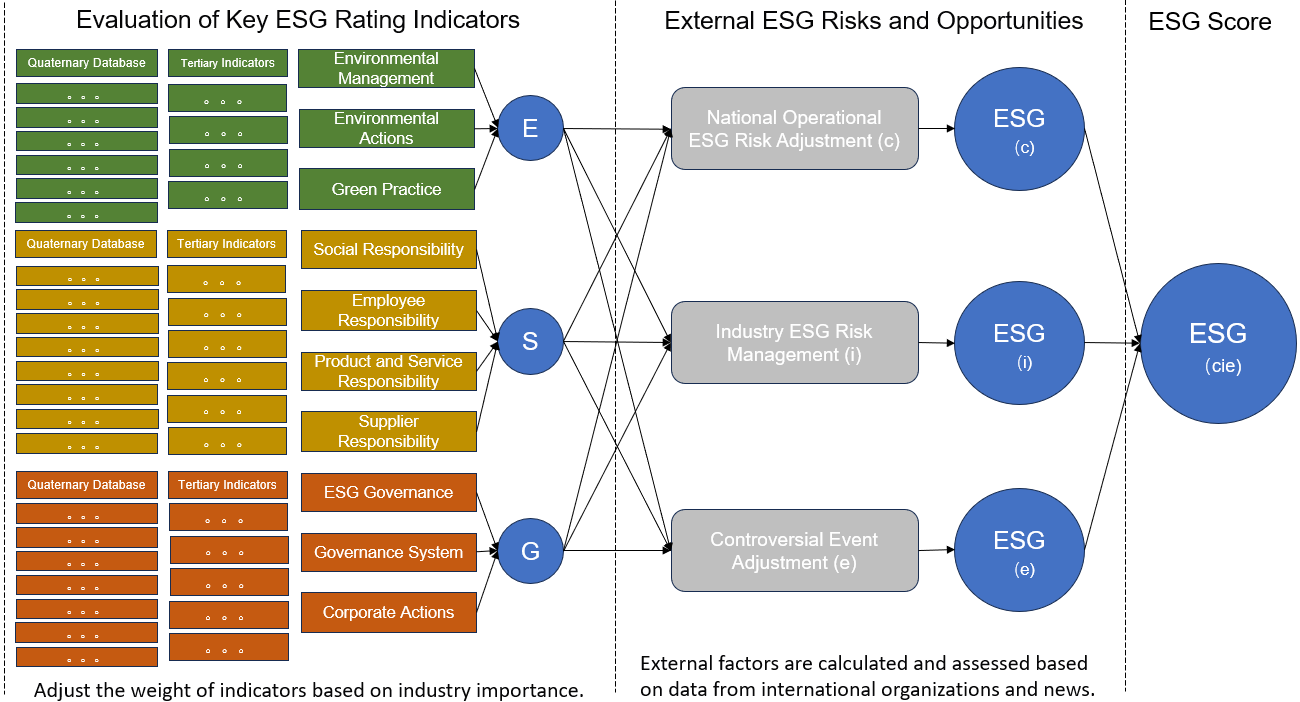

Lianhe Green has adopted a complete framework and indicator system in its ESG ratings, covering the three core dimensions of environment, society and corporate governance. Under each dimension, it is further subdivided into a number of specific indicators to form a multi-level assessment system to comprehensively reflect the ESG performance of companies. In addition, Lianhe Green correlates ratings with industry risks, country operational risks and controversial events to better assess the ESG risks faced by companies. Through this systematic approach, Lianhe Green provides a comprehensive assessment of a company's sustainable development.

Lianhe Green ESG Rating Flowchart

2.4 ESG Rating Levels

Lianhe Green's ESG ratings are categorized into nine levels, ranging from AAA at the highest to C at the lowest. Each level corresponds to specific ESG performance and risk characteristics, helping investors and companies quickly understand their ESG management level and potential risks.

ESG Rating Classification

| Level | Description |

| AAA | Exceptional leadership and innovation in sustainable development. |

| AA | Outstanding sustainable development performance and strong leadership. |

| A | Good sustainable development performance and commitment to continuous improvement. |

| BBB | Good sustainable development performance and management capabilities. |

| BB | Moderate sustainable development performance and average management skills. |

| B | Some deficiencies in sustainable development that require improvement. |

| CCC | Significant challenges in sustainable development that require substantial improvement. |

| CC | Severe deficiencies in sustainable development that require immediate improvement. |

| C | Extreme deficiencies in sustainable development that require fundamental improvement. |

2.5 Lianhe Green ESG Rating Indicator System

The core indicators of the Lianhe Green ESG Rating Methodology can be seen in the hierarchical structure shown in the following chart.

Lianhe Green ESG Rating Indicator System

|

Primary Indicators |

Secondary Indicators |

Tertiary Indicators |

|

Environmental responsibility |

Environmental management |

Environmental management system |

|

Tackling climate change |

||

|

Environmental actions |

Carbon emissions |

|

|

Waste management |

||

|

Resource management |

||

|

Ecological and environmental protection |

||

|

Green practice |

Green finance |

|

|

Green operation |

||

|

Social responsibility |

Social responsibility |

Community contributions |

|

Tax status |

||

|

Job creation |

||

|

Employee responsibility |

Employee development |

|

|

Employee safety |

||

|

Employee compensation and benefits |

||

|

Fair employment |

||

|

Product and service responsibility |

User satisfaction |

|

|

Products and services |

||

|

Responsible marketing |

||

|

Intellectual property management |

||

|

Technological innovation |

||

|

Supplier responsibility |

Supplier management system |

|

|

Performance |

||

|

Governance responsibility |

ESG Governance |

ESG governance |

|

Governance system |

Governance structure |

|

|

Compliance & Risk |

||

|

Corporate Actions |

Business ethics |

|

|

Governance performance |

3. Lianhe Green ESG Rating Report

Lianhe Green is commissioned by companies or investors to conduct ESG ratings and issue corresponding ESG rating reports. Lianhe Green adopts a multi-dimensional and internationalized assessment framework to comprehensively consider the client's performance in the three core areas of environment, society and corporate governance. Through interviews with the assessed companies, on-site inspections, and other information, Lianhe Green will conduct in-depth ratings, analysis, and comparison, and provide a comprehensive ESG rating report. This aims to help companies and investors grasp the continuous performance, risks, and strengths of enterprises in the ESG field from the perspective of assessment methods that comply with international and domestic standards.

ESG Rating Report Sample